The tools are free to use and very simple. Purchase Amount $ Purchase Location ZIP Code -or- Specify Sales Tax Rate Calculate Sales Tax How does the Rancho Cucamonga sales tax compare to the rest of California?

How to Set Tax Rates | Houzz

The average cumulative sales tax rate in Rancho Cucamonga, California is 8.15% with a range that spans from 7.75% to 8.75%. This encompasses the rates on the state, county, city, and special levels. Rancho Cucamonga is located within San Bernardino County, California.

Source Image: intero.com

Download Image

Depending on the zipcode, the sales tax rate of Rancho Cucamonga may vary from 7.75% to 8.75% Every 2024 combined rates mentioned above are the results of California state rate (6%), the county rate (0.25%), the Rancho Cucamonga tax rate (0% to 1%), and in some case, special rate (1.5%).

Source Image: linkedin.com

Download Image

Tax rates : r/Arkansas The sales tax rate in Rancho Cucamonga is 7.75%, and consists of 6% California state sales tax, 0.25% San Bernardino County sales tax and 1.5% special district tax.

Source Image: omnihotels.com

Download Image

Sales Tax Rate For Rancho Cucamonga California

The sales tax rate in Rancho Cucamonga is 7.75%, and consists of 6% California state sales tax, 0.25% San Bernardino County sales tax and 1.5% special district tax. Rancho Cucamonga City is located in San Bernardino County in California, United States, and has a sales tax rate of 7.75%. This includes local and state sales tax rates. Here is the breakdown of the Rancho Cucamonga City’s sales tax: Sales Tax Rates in Rancho Cucamonga City by Zip Codes and Districts

Omni Rancho Las Palmas Resort & Spa | Rancho Mirage Hotels

2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 The Rancho Cucamonga sales tax has been changed within the last year. New California city sales tax rates take effect on April 1

Source Image: napavalleyregister.com

Download Image

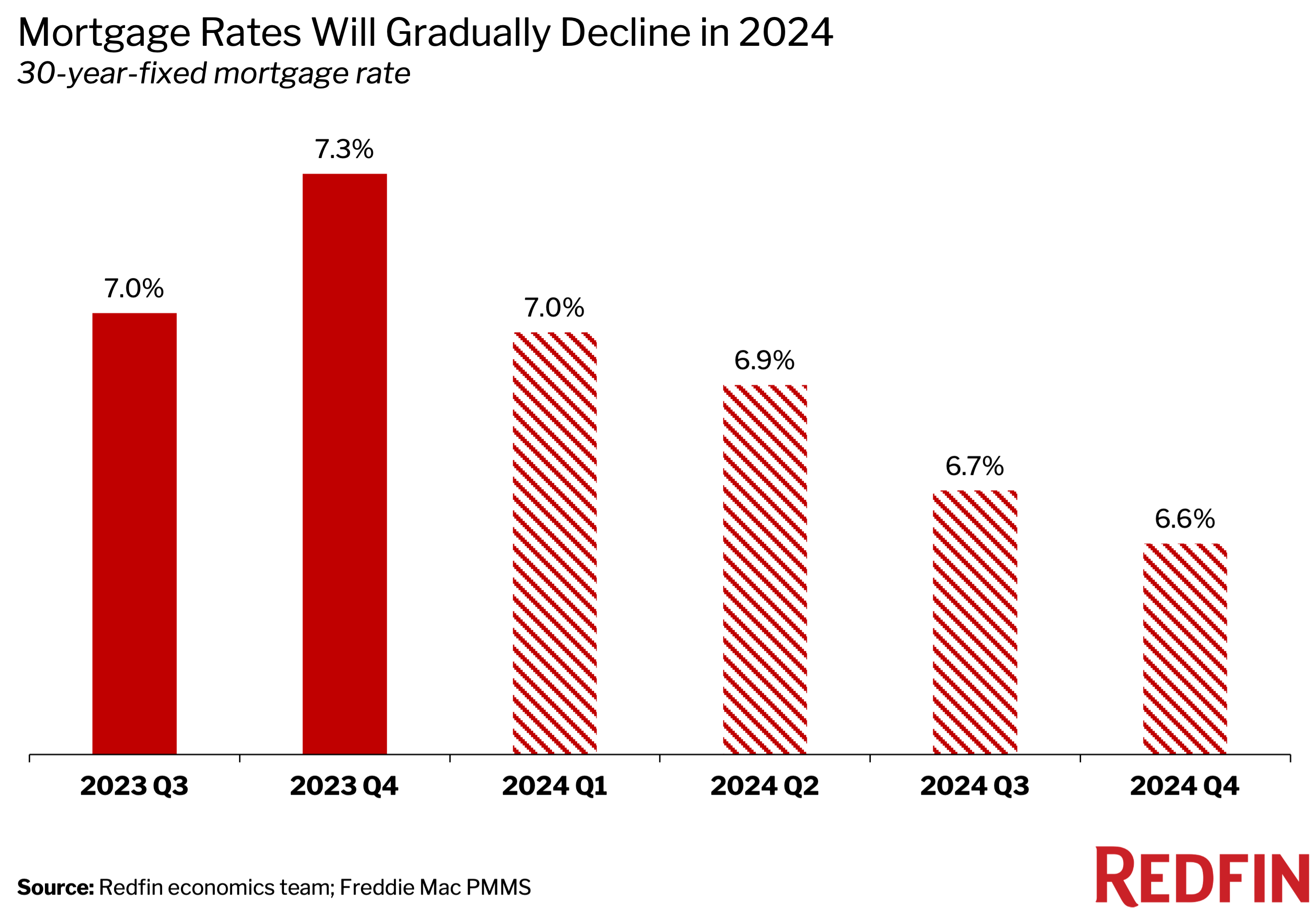

Redfin Predicts 2024 Will Be the Year Homebuyers Catch a Break, With Home Prices Falling and New Listings Rising 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 The Rancho Cucamonga sales tax has been changed within the last year.

Source Image: redfin.com

Download Image

How to Set Tax Rates | Houzz The tools are free to use and very simple. Purchase Amount $ Purchase Location ZIP Code -or- Specify Sales Tax Rate Calculate Sales Tax How does the Rancho Cucamonga sales tax compare to the rest of California?

Source Image: houzz.com

Download Image

Tax rates : r/Arkansas Depending on the zipcode, the sales tax rate of Rancho Cucamonga may vary from 7.75% to 8.75% Every 2024 combined rates mentioned above are the results of California state rate (6%), the county rate (0.25%), the Rancho Cucamonga tax rate (0% to 1%), and in some case, special rate (1.5%).

Source Image: reddit.com

Download Image

Rancho Cucamonga, California (CA) profile: population, maps, real estate, averages, homes, statistics, relocation, travel, jobs, hospitals, schools, crime, moving, houses, news, sex offenders Sales Tax Breakdown US Sales Tax Rates | CA Rates | Sales Tax Calculator | Sales Tax Table The latest sales tax rate for Cucamonga (Rancho Cucamonga), CA. This rate includes any state, county, city, and local sales taxes. 2020 rates included for use while preparing your income tax deduction.

Source Image: city-data.com

Download Image

California Sales Tax Updates – Logistis The sales tax rate in Rancho Cucamonga is 7.75%, and consists of 6% California state sales tax, 0.25% San Bernardino County sales tax and 1.5% special district tax.

Source Image: logistis.us

Download Image

Is Thousand Oaks, CA a Good Place to Live? Real Estate, Jobs, Lifestyle – Redfin Rancho Cucamonga City is located in San Bernardino County in California, United States, and has a sales tax rate of 7.75%. This includes local and state sales tax rates. Here is the breakdown of the Rancho Cucamonga City’s sales tax: Sales Tax Rates in Rancho Cucamonga City by Zip Codes and Districts

Source Image: redfin.com

Download Image

Redfin Predicts 2024 Will Be the Year Homebuyers Catch a Break, With Home Prices Falling and New Listings Rising

Is Thousand Oaks, CA a Good Place to Live? Real Estate, Jobs, Lifestyle – Redfin The average cumulative sales tax rate in Rancho Cucamonga, California is 8.15% with a range that spans from 7.75% to 8.75%. This encompasses the rates on the state, county, city, and special levels. Rancho Cucamonga is located within San Bernardino County, California.

Tax rates : r/Arkansas California Sales Tax Updates – Logistis Sales Tax Breakdown US Sales Tax Rates | CA Rates | Sales Tax Calculator | Sales Tax Table The latest sales tax rate for Cucamonga (Rancho Cucamonga), CA. This rate includes any state, county, city, and local sales taxes. 2020 rates included for use while preparing your income tax deduction.